Reuters is reporting that MSCI is considering removing all of Russia’s listed stocks from its indexes.

The action follows stringent new sanctions and central bank restrictions on trading.

Dimitris Melas, MSCI’s head of index research and chair of the Index Policy Committee, told Reuters “It would not make a lot of sense for us to continue to include Russian securities if our clients and investors cannot transact in the market.”

Russia has a weighting of 3.24% in MSCI’s emerging market benchmark and a 30 bps weight in global benchmarks.

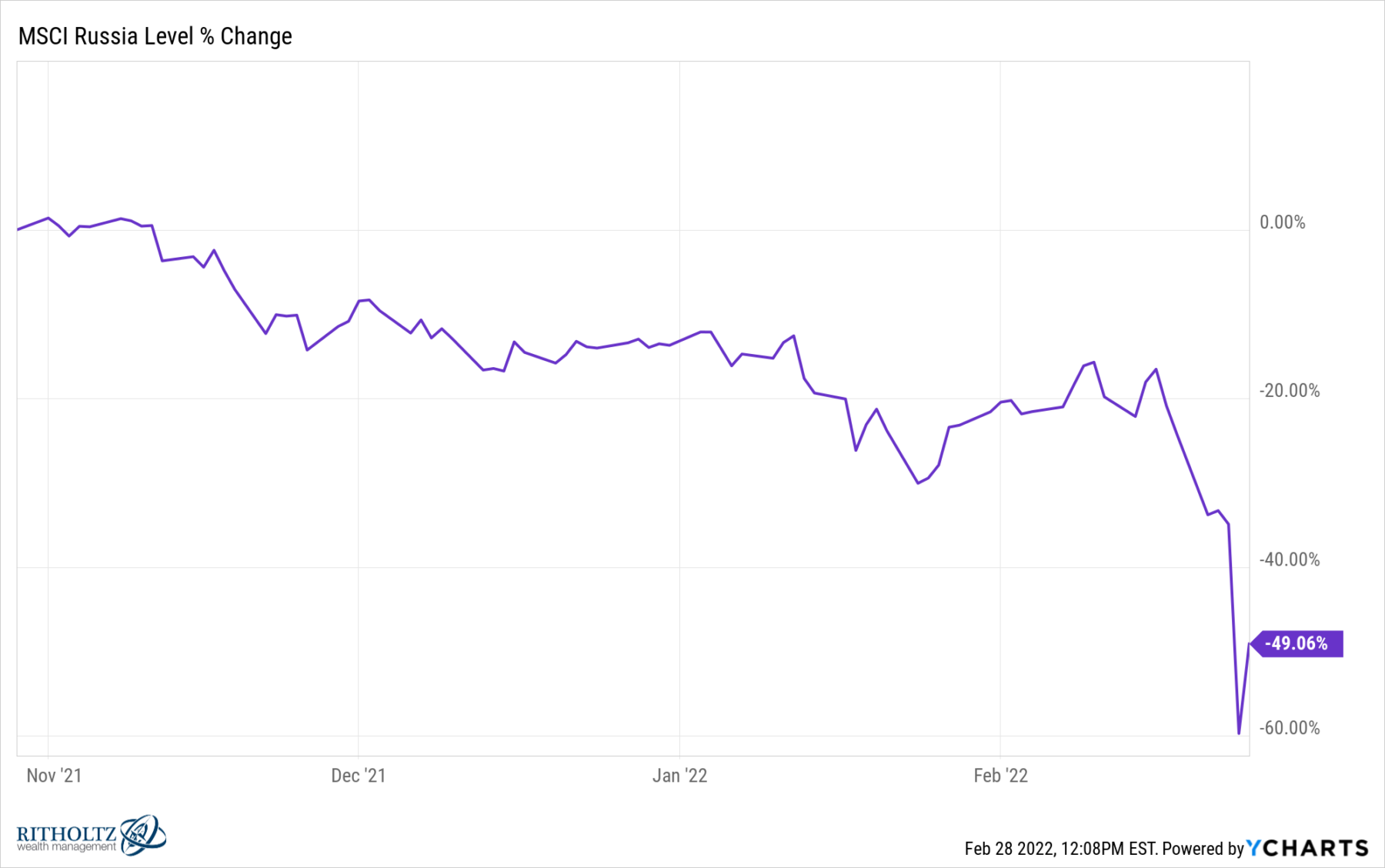

The Moscow exchange did not open today, but U.S.-based Russian ETFs are still trading here. There are 27 ETFs that have >5% of their portfolios in Russian stocks. Russia’s bourses have fallen about half from November 2021 highs; A 10-year chart shows the Russian bourses cut in half since 2012. The Russian Ruble has also fallen about 30%.

David Nadig at ETF Trends observes that “folks in giant ETFs like the iShares Emerging Markets ETF (EEM), are going to realize that they have just a little bit of exposure here — usually a few percent. They may also realize that they have exposure to China, Brazil, and Saudi Arabia…”

Eliminating Russia from your holdings is a relatively painless way to take a stand, as they are but 1-2% of traded global equities. China represents about a third of emerging markets, while Saudi Arabia has relations with just about every energy firm on the planet. Those two represent a more challenging sell decision as they represent substantial parts of global GDP.

Previously:

How Geopolitics Impacts Markets (1941-2021) (February 25, 2022)

No comments:

Post a Comment